The Bordeaux Value Equation. Part 1.

A data-driven guide for the drinkers and collectors.

We all know the feeling: you spot a Bordeaux that looks reasonably priced, but is it actually any good? For most of us, CellarTracker becomes the first port of call—9 million users rating wines they’ve actually bought and drunk. Sure, it’s not perfect, but for widely consumed Bordeaux, this crowd-sourced democracy surely beats any single critic’s opinion. Since this analysis is for drinkers, not speculators, CT made perfect sense.

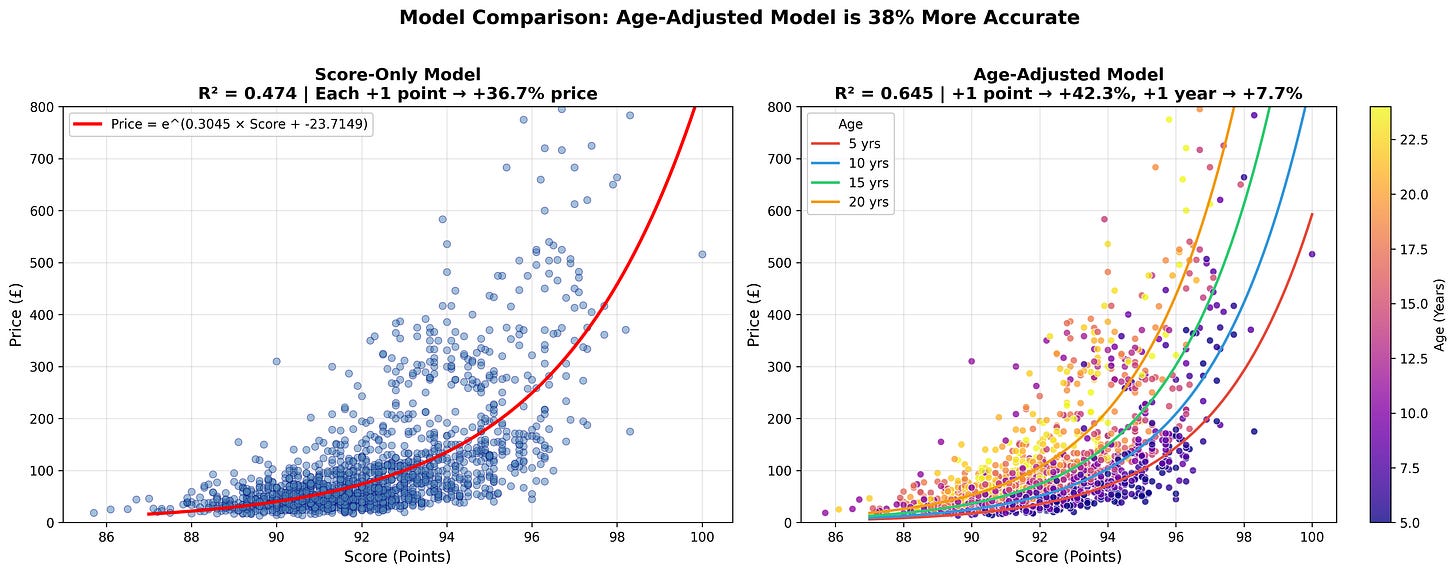

1637 red Bordeaux wines were analyzed across 20 vintages (2000-2019). The last 5 vintages 2020-2024 were omitted due to lack of review depth. Then, incorporating market data from WineStreet, we built an age-adjusted pricing model that predicts wine values with 38% more accuracy than score-only approaches.

In Part 1, we’ll uncover the fundamental value equation. In Part 2 (coming soon), I’ll reveal which of these are worth buying in the context of the current market, considering things like bid momentum, sales and price directionality.

1. THE AGE-ADJUSTED PRICING MODEL: WHY OLDER ISN’T ALWAYS BETTER

Here’s what some people miss: they focus on scores, ignoring age.

But Bordeaux pricing follows a mathematical relationship:

Price = e^(0.353 × Score + 0.074 × Age - 29.28)

Translation:

• Each quality point increases price by 42.3%

• Each year of age increases price by 7.7%

• Age and quality work INDEPENDENTLY

The Model’s Performance:

• Age-adjusted R²: 0.65 (explains 65% of price variance)

• Non-age-adjusted R²: 0.47 (explains only 47%)

• Improvement: 38% more accurate than ‘scores only’ approach.

══════════════════════════════════════════════════════

2. THE TOP VALUE VINTAGES: WHERE 2019 RANKS (AND SURPRISES)

Using the age-adjusted model, I calculated “value ratios” for every vintage:

Value Ratio = Actual Price / Expected Price

Ratios >1.0 = undervalued

Ratios <1.0 = overvalued

TOP 10 VALUE VINTAGES:

The Surprises:

2000/2005 are Undervalued on an age-adjusted basis, despite being 20+ years old. Why? Scarcity (79 châteaux tracked vs 94-95 for recent vintages) meets quality (92.7 avg score). Age premium (7.7% × 24 years) should push prices higher, but hasn’t. Perhaps there’s a cliff for age we should investigate with more time.

2018 and 2019 are BOTH undervalued: Many focus on 2019. But 2018 (1.51x) actually edges out 2019 (1.38x) in value ratio. With lower average prices, 2019 combines high scores (93.8) with youth (5 years) at bargain prices.

2009 beats 2010: 2010 is, for many, the “vintage of the century”, but 2009 offers better value at similar quality (93.3 vs 93.2 avg score).

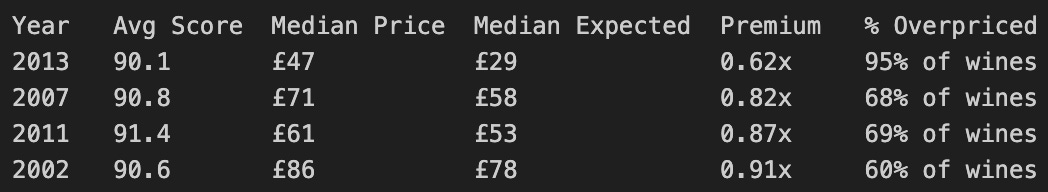

WORST VALUE VINTAGES (Most Overpriced):

The Pattern: Old vintages (2013, 2007, 2011, 2002) with mediocre scores command premiums purely due to age. But the model says they’re overpriced by 40-95%.

The Takeaway: Focus on 2000, 2005, 2018, 2019 for quality and age-adjusted value. Avoid 2013 and 2007.

3. THE £40 MIRACLE: CLASSIFIED GROWTHS TRADING AT CRU BOURGEOIS PRICES

How much should you pay for a classified growth scoring 92+ points?

According to the market: Most 92+ classified growths cost £88-£218 (median to average). But I found 15 classified growth wines trading UNDER £40—less than half the median price.

THE VALUE LIST:

What You’re Getting:

✓ 2ème Cru Classé (Léoville estates, Gruaud Larose)

✓ 4ème-5ème Cru Classé (Pontet-Canet, Branaire-Ducru)

✓ 92-93+ point scores (world-class quality)

✓ £25-50 prices

Many buyers chase “trophy” vintages or brands and ignore solid vintages from great producers. 2017-2019 Léoville Barton at £38-50? That’s a 2nd growth wine competing with (and sometimes beating) wines at multiples of it’s price point.

Expected price for 92-point, 5-year-old classified growth is £80-120 but they’re trading at £25-50. That’s 50-70% below fair value!

When the market wakes up to their quality in 3-5 years, these prices will multiply. You’re getting Grand Cru Classé insurance at Cru Bourgeois premiums.

4. THE BRAND TAX: WHEN YOU’RE PAYING FOR NAME, NOT QUALITY

This may be obvious but there are multiple vintages where wines with scores under 92 points are trading over £150. These, of course are vintages to avoid.

THE “BRAND TAX” VINTAGES: 2013, 2003, 2002 & 2007.

All of these vintages trade at a significant premium to their expected value.

These weren’t exactly knock out vintages and the market is kept afloat by those who don’t consider quality but rather prefer to obsess on the label. Hence there are some wines that command a price of £200-400 regardless of vintage quality.

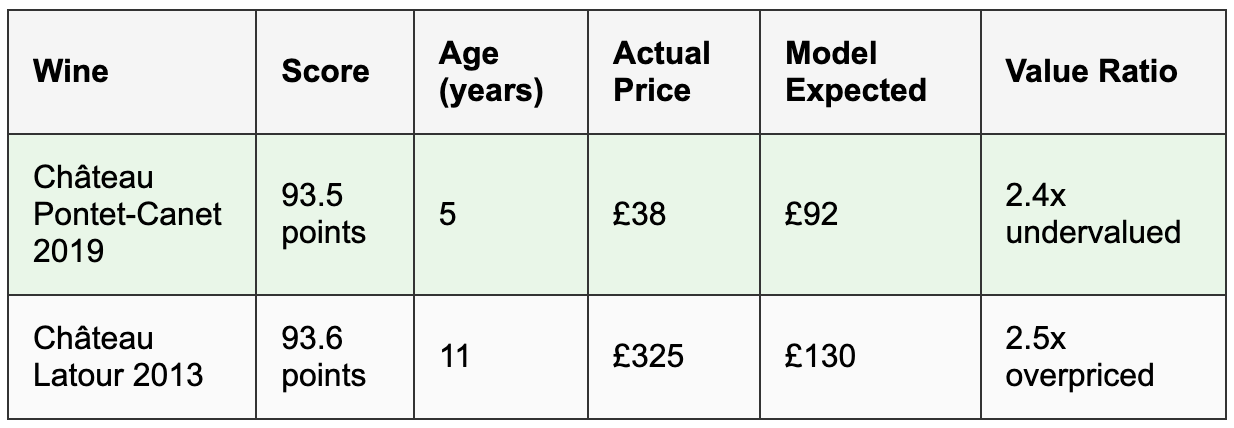

Real-World Example

Same quality, vastly different prices. More on this to come in Part 2.

5. THE CASE FOR 2016: 94+ POINTS FOR £45-90

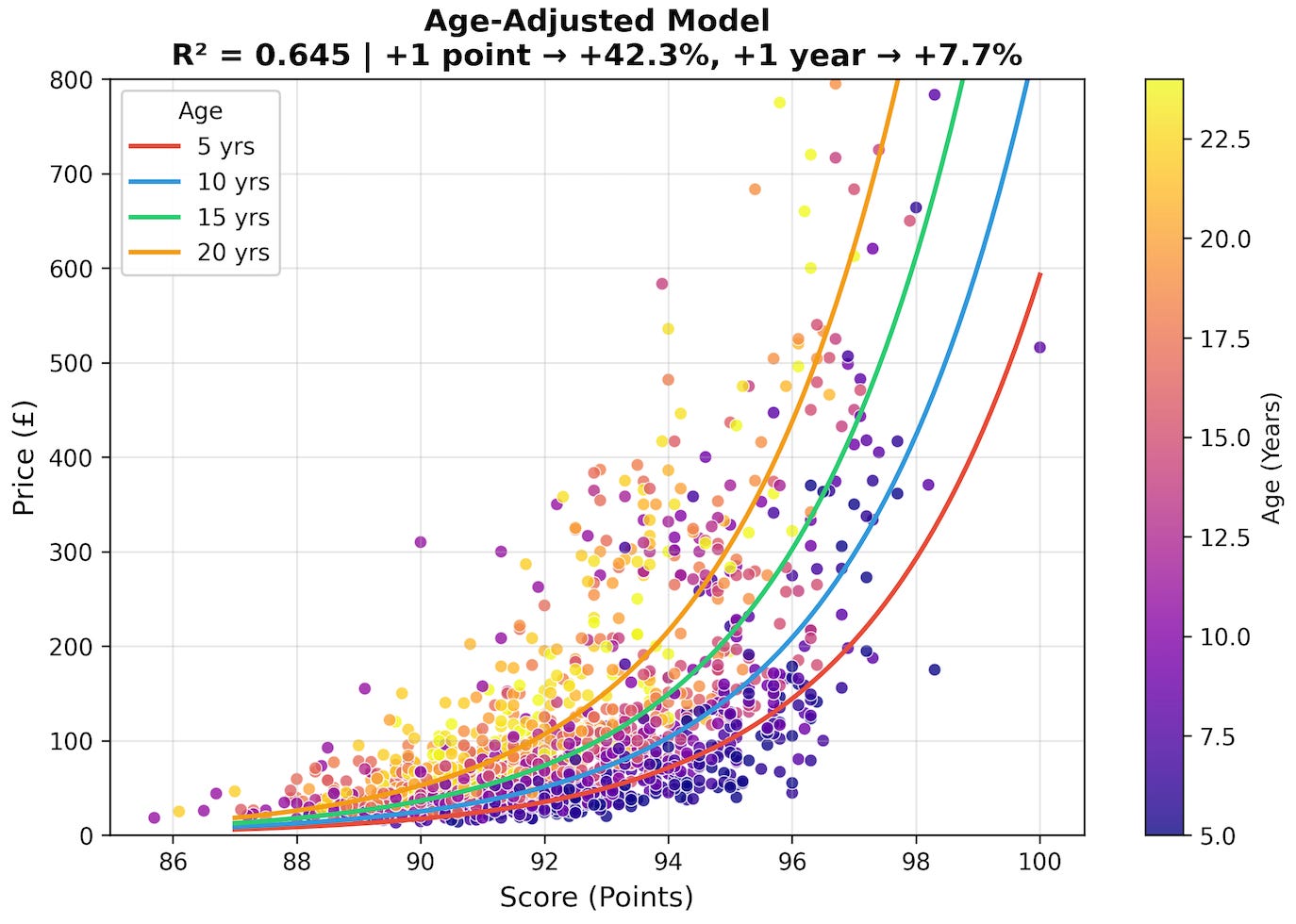

2016 is widely recognised as an excellent vintage. It has an avg score of 93.9 which is 3rd highest in 20 years. It says a lot to have such high scores during an awkward phase of drinking, having lost their youthful exuberance and not yet fully developed. These are extremely long-lived wines which are approaching their 10th birthday. And we can see what happens high-scoring wines with 10 years age on them.

Fear not, I’ve compiled a list so you can buy them while they’re still accessible. In 5 years, when 2016 enters its optimal drinking window (2029-2045), many of these blue dots will have moved north and be hanging out with the orange dots.

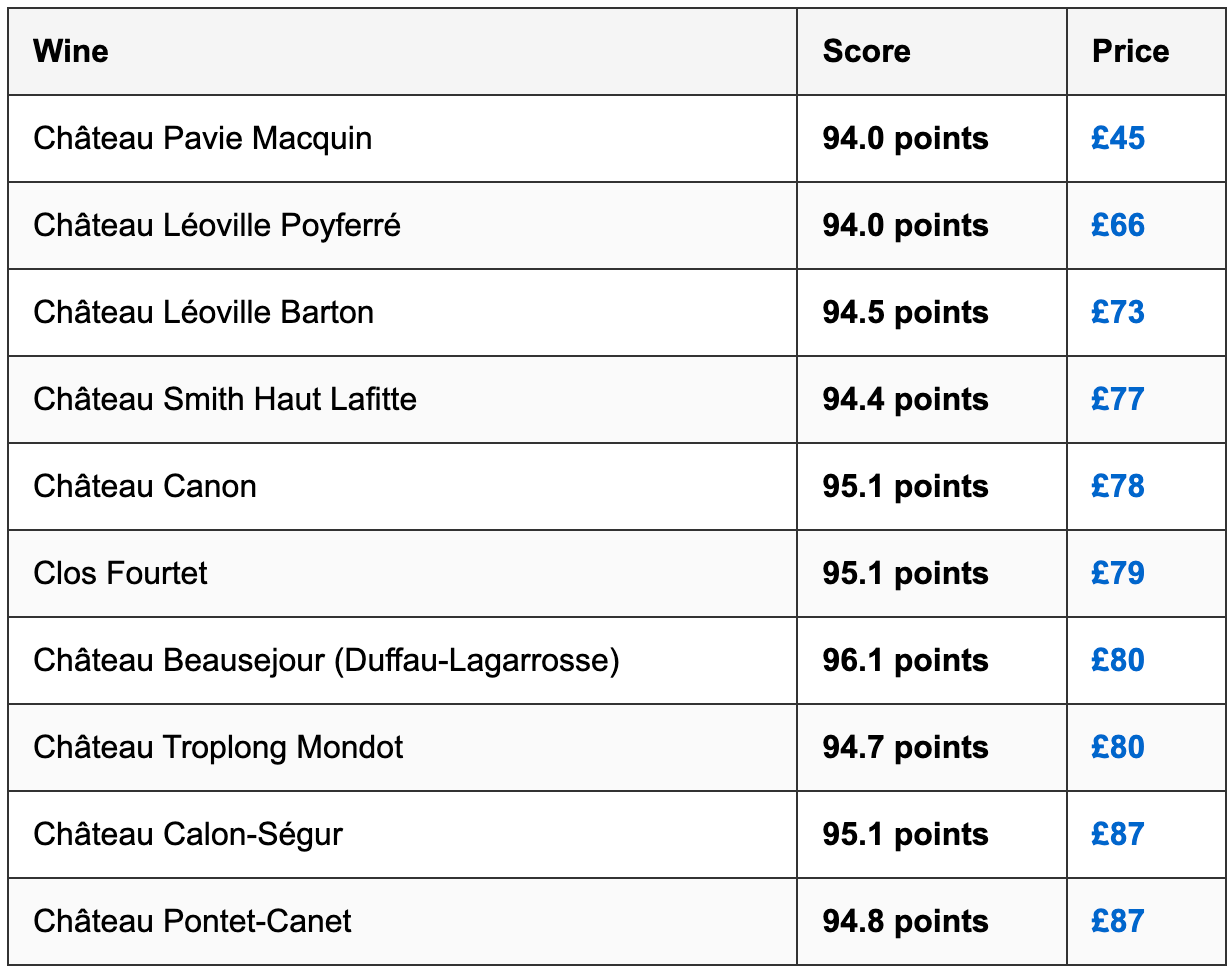

The 2016 Under-£90 List (94+ Points)

What You’re Getting:

✓ 94-96 point scores (world-class quality)

✓ £45-87 prices (50-70% below first growth equivalents)

✓ 2016 vintage (one of the best of the last two decades)

The Standouts:

Pavie Macquin 94.0 for £45: St-Émilion Grand Cru Classé A at Cru Bourgeois pricing. Expected value: £85-100. You’re getting it for half.

Beausejour Duffau 96.1 for £80: Scores better than Cheval Blanc 2016 which trades aroun £500.

Canon 95.1 for £78: Iconic St-Émilion Premier Grand Cru Classé B estate with near-perfect scores from critics and the public.

I think 2016s are facing an age paradox. At 9 years old, they are too young to drink optimally, too old for the recency bias which boosts sales of younger vintages around En Primeur.

The above wines represent discounts of 50-60% below expected value.

This might be the sweet spot: quality + youth + discount.

We’ve identified the undervalued vintages, £40 classified growths, and systematically cheap châteaux.

But here’s the catch: over 10% of these “bargain” wines have ZERO buyer interest in the current market. Red flag or buying opportunity?

In Part 2 of this series, I’ll reveal:

• Which of these value wines are actually bouncing back from market lows

• Which are still falling (despite looking “cheap”)

• Why Pontet-Canet 2019 at £38 has 40 active bids but prices keep dropping

• Why so many wines, despite being “undervalued,” have 0 bids

• A revised buy list based on reversal signals + bid support (if you care about all that).

Because knowing what’s undervalued is only half the equation. Knowing WHEN to buy it—that’s where the real money is made (or saved).

Love this and love how it's presented, excellent work