Lessons learned from one year trading wine.

Biggest wins, costly mistakes, and why the (unregulated) house always wins.

The email notification pinged at 11:47 AM on a Tuesday.

“BB&R Delivery Confirmation - It's Arrived”.. “your wines should be visible within your stock inventory within the next 2-3 working days”

They were referring to cases arriving from Farr Vintners which we’d taken a colossal punt on, including the 2010 La Belle Helene, Cote Rotie from Michel & Stephane Ogier purchased for £825/3.

Now this looks a smart buy today, with prices more in the region of £1500/3. However at the time, there were other listings available for ca. £900/3, but thirsty for some gains we bought it and sent it to BBR where there was a bid at £1500/3.

By the time the wine showed up in my BBR account there were no live bids on the case, and we were looking at a loss.

After a couple days, deliberating what to do next, I decided I’d flog it at auction to recycle capital fast- losses be dammed. Right before I did so, the wine gods smiled down on me and another email notification pinged.

“New BBX Bid 2010 Côte-Rôtie, La Belle Hélène, Domaine Michel & Stéphane Ogier, Rhône”

I frantically opened the email in anticipation.

“Highest Bid: £1500 per case (3) - 1 In Bond Case”

I hit the bid immediately, knowing I’m not out of jail yet because BBR allow buyers 14 days to cancel.

Thankfully, this time I got lucky. But it was a reminder of the risks of trading in an unregulated market where a "confirmed" sale can evaporate faster than a cheap red left open overnight. This brings us to our first lesson.

Always Check The Rearview Mirror.

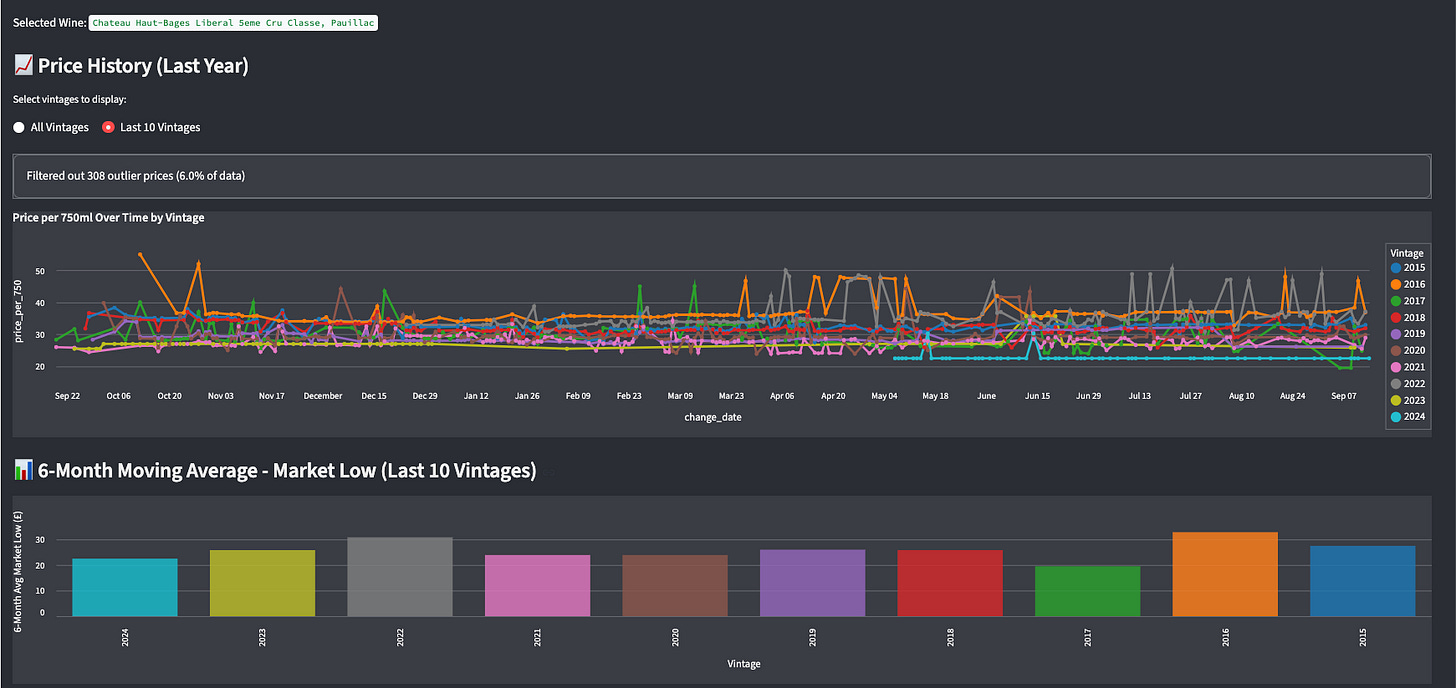

It can be very tempting to go for a trade where some idiot has bid above market. But this is dangerous territory. You have to remember that in many cases (such as with BBR), bids are not final and can easily get cancelled, even after they’ve been accepted. Always check the price history of a wine. The average price chart on wine-searcher is a bit useless, because averages are easily skewed by aspirational prices. Better to check the Price History page over on WineStreet, which tracks historic market low p750ml and provides some cross vintage analytics.

Ensure, regardless of bid, you are buying at a historically good price. That way, even if the bid vanishes, you have limiting your downside.

The Unregulated Advantage.

It’s the 21st of April. Concerned over a downward trend, you’ve just sold the last of your META stock at ~$484 USD. Within a week, the stock has popped and is trading around ~$550 USD. You’ve clearly fucked up and wish you could go back and cancel your sale, but obviously can’t, because you’re trading in a regulated market.

In wine, the trading platforms hold all the cards. Too frequently, I’ve scooped up below-market deals, only for them to be cancelled by the platform a few days later, and re-listed at a much higher price. This is the equivalent of me buying META on the 21st of April and the trade gets cancelled a week later because the seller left money on the table.

The challenge is that different platforms have different policies around trade cancellations. Some are transparent about giving users flexibility to cancel, others market themselves as having "guaranteed execution." But even on platforms that promise binding trades, there can be exceptions - technical issues, verification problems, or other circumstances that allow deals to be unwound.

The lesson isn't to avoid any particular platform, but to understand that in an unregulated market, "guaranteed" often comes with invisible asterisks. Factor this uncertainty into your risk calculations, because no matter what the terms say, it's often heads they win, tails you lose.

Chasing High ROI Can Be A trap.

At the beginning of our trading campaign, we prioritized high ROI [%] trades. The logic being, even for lower value [£] trades, they will compound over time and we’ll end up with greater gains.

However we didn’t factor in the operational overhead associated with trading large volumes of wine. We were moving around so many mid-to-low-value cases between warehouses, liaising with logistics teams, drowning in emails and transfer fees. After a few month’s we realized this wasn’t sustainable and was consuming too much bandwidth. A conscious switch was made to focus on higher value [£] returns instead of obsessing over ROI [%]. Better to make 10% on £10,000 than 25% on £2,000, especially when both options require about the same time investment.

Quickly we found overall profits rising and better yet, we reclaimed some time which we could use to focus on building the tech driving the whole operation.

When chasing your gains on WineStreet, be sure to use our sorting features depending on your goals.

Beyond Arbitrage. Predictive vs. Reactive Trading

Towards the end of our first year trading, we made another important realization. There is a ceiling to the amount of money you can make arbitraging wine. Specially if you’re operating in one geography like us (although this is planned to change).

It’s easy to get distracted by the prospect of free money. But the real alpha comes from using the data to make more informed purchases than others. This means applying modern data science techniques to find wines likely to appreciate. This is where you can really get ahead of the pack. Our algorithm ingests indicators related to supply (availability), demand (bids), prices, spreads, popularity (social media), auction results, critics and community scores.

This is where we see greatest potential for growth as WSB enters it’s second year.

Chose Your Poison

In one year of trading, we’ve dealt with 21 different wine merchants and exchanges. It’s become clear that relationships and loyalty matter. It’s no secret that in wine, the more you buy, the better you are treated. While we’re certainly not on the allocation list for DRC yet, some merchants have started to give us discreet deals on under market stock. I guess for distressed sellers, it’s nice to know we’re often a buyer.

There are too many merchants to review comprehensively, but after my earlier rant about platform risk, these ones are worth calling out for their strengths and are among our most frequently used (despite their downfalls):

LiveTrade (Bordeaux Index) gives you the ability to close trades on wines stored outside their warehouses- a huge advantage in a world of uncertainty. Low commission on LiveTrade+ wines.

BBX has the most price insensitive buyers to the point where sometimes it seems like money laundering. It has fantastic liquidity too. But the selling commission (10%) is a killer compared to 5% on Cru and even less on CultX.

Hatton & Edwards offer some seriously sharply priced stock. But it moves fast, and twice we’ve had the wrong-sized cases turn up.

CultX have some insane fire-sales. Distressed sellers?

Cru World Wine offers global liquidity, 5% selling commission (on platform only) and a solid website.

Lay & Wheeler used to be great for flogging single bottles but their new check-in fees and high commission makes this no longer a viable option.

Don’t rule out bidforwine.co.uk as a last resort for liquidation.

More international trading options are coming soon. Stay tuned.

Looking Back, Moving Forward

A year ago, we thought wine arbitrage was about finding price discrepancies and capitalizing on inefficiencies. We've learned it's actually about navigating power imbalances, managing operational complexity, and building sustainable alpha in an unregulated market.

The lessons above weren't cheap - each one cost us time, money, or both. But they've validated our core thesis: that data and technology can create real advantages in wine markets. More importantly, they've taught us to approach every new hypothesis with a proper null hypothesis - no more assuming something works just because it sounds logical.

We're doing more than just trying to make money trading wine. Through WineStreet, we're building the technology that collectors and businesses need to navigate what's become a far more complex landscape than it used to be. The same data science techniques that help us identify undervalued wines can help others make better buying, selling, and collecting decisions.

Year two starts now. Here's to building smarter tools, making more money and fewer mistakes.